Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Lidar maker Oster has acquired StereoLabs, a company that makes vision-based perception systems for robotics and industrial applications, for $35 million and 1.8 million shares.

The deal is the latest in a drive toward consolidation among perception sensor suppliers. Just last month, MicroVision bought the lidar assets of thriving but now bankrupt Luminar For 33 million dollars. Ouster itself has played the M&A game a fair amount as well. In 2022, the company merged with competitor Velodyne. The year before that, Bought lidar startup Sense Photonics.

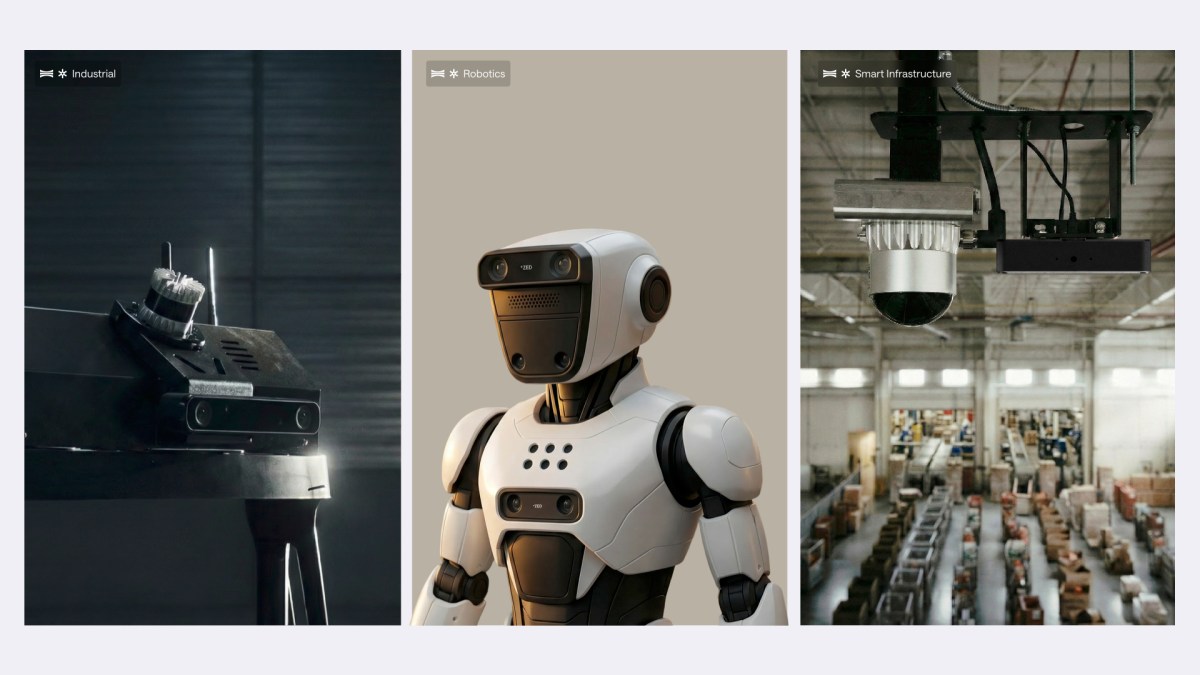

This consolidation happens right as companies and investors Rush to build a business About “physical AI” – a broad term that includes everything from humanoid robots and drones to self-driving cars and automated systems in warehouses. Even more obscure suppliers are as well Raising large funding rounds With the development of these technologies. Some startups are even trying to pivot Completely new sensing methods.

Angus Pacala, co-founder and CEO of Ouster, told TechCrunch in an interview that he had been eyeing StereoLabs for years. He said he saw lidar technology as “the essential component of systems capable of achieving safety criticality,” but he wanted to “take it to a higher level.”

The “obvious additional sensors” to start working on in addition to lidar are cameras, Pacala said. Pacala said the 15-year-old company StereoLabs is “best in class” in terms of hardware, but he was particularly drawn to how the company is getting the most out of those cameras by being “incredibly smart about adopting the latest AI and edge computing models.”

In particular, Pacala highlighted StereoLabs’ development of a basic AI model that can determine the depth of objects from stereo cameras.

“It was a no-brainer for us to go out and approach them and put forward this vision of working with us to become a unified platform for sensing and perception — a Tier 1 (supplier) of these advanced physical AI systems,” Pacala said.

TechCrunch event

Boston, MA

|

June 23, 2026

Despite the focus on integration, Oster said StereoLabs will operate as a wholly owned subsidiary.

Although the hype was feverish, Pacala said he did not buy StereoLabs simply because of the interest and money being spent on physical AI. In fact, he committed perhaps the most serious sin one can commit during a hype cycle: he poured some cold water on the hype, especially around humanoid robots.

“The business model here is not just about hyping up, it’s actually about creating reliable, safe business systems and actually solving customer problems,” he said. “There’s going to be a little bit of disillusionment with physical AI, as it turns out it’s time to commercialize all these human beings.”

Baccala isn’t the only one trying to take a realistic view. In a recent interview with TechCrunch, MicroVision CEO Glenn DeVos said the sensor industry is “ripe for consolidation” because he believes there is not enough revenue to support all the existing competition.

“You’re going to get consolidation, or you’re going to get some kind of weeding out of the industry when people fall by the wayside,” he said.