Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

I used TurboTax To file my taxes for several years. It’s the most popular DIY Tax serviceand are often also the cheapest and most straightforward. TurboTax With the blogger in mind by using an easy-to-use interface, offering expert help available, with different options for automatic document uploading; Helpful advice and information regarding tax requirements; Transparent and low-cost options for every file type.

The service makes it very easy for returning users by storing previous years’ information, allowing for easy automatic loading and remembering of previously used selections and forms from past years. Doing my taxes as a returning user with TurboTax takes a fraction of everyone else’s time Tax services I’ve tested. (Need a starting point? I have a guide on that How to file your taxes online For additional help.)

If you haven’t tried TurboTax, now is the best time to see if it’s right for you (and be able to file for free). You can file state and federal taxes for $0 right now. There are only a few requirements for this great free registration deal. You must not have filed for TurboTax before (and you are switching from another provider), and you must file in TurboTax mobile app By February 28th. You’ll need to get started and apply within the mobile app; This only qualifies for DIY (self-directed) tax services and excludes expert help products. This means that it applies to The simple form returns only 1040 (Meaning no schedules, except EITC, CTC, student loan interest, and Schedule 1-A forms are eligible).

One downside to TurboTax is that while it is (in my opinion) the easiest interface to use with smooth auto-upload features, it can be a little more expensive than similar competitors. I’ve used FreeTaxUSA in the past, when my income was lower and my taxes were simpler. The service is very similar to TurboTax in design, and while it’s still a low-cost option, it’s not 100 percent free, as it charges $16 to file a state return. Additionally, when I tested the service last year, FreeTaxUSA gave me the most back taxes of all the services I tested.

TurboTax filed more than twice as many free returns as FreeTaxUSA last year (based on the total number of federal and state returns filed in tax year 2024). This tax season, more than 100 million people in the U.S. are eligible to file free tax returns with TurboTax. If you file your federal and state returns using DIY TurboTax products, filing is free if you use the mobile app through February 28.

Filing taxes can be confusing and potentially expensive. While I urge anyone who has not filed for TurboTax to take advantage of the free federal and state filing deal by Mobile appThere are several options if you have filed for the service before or have more complex returns that may require additional assistance.

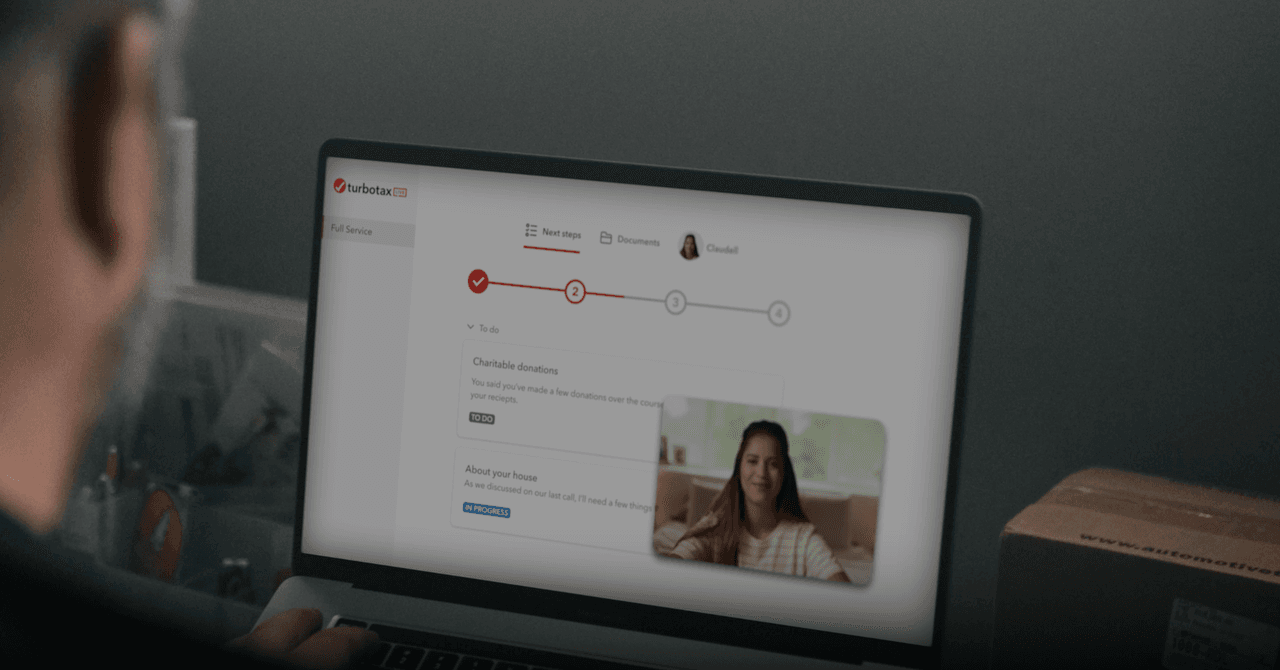

There are three file options: DIYwhere you give yourself step-by-step instructions (the aforementioned service qualifies for the free sign-up deal); Expert helpwhere you can get help from tax experts throughout the process and ask the expert to review it before submitting it; Or you can also have your taxes completely done by a local tax expert Complete expert service. Prices vary depending on the level chosen and when you apply (the earlier, the cheaper, especially if you are able to apply before March).

The application process begins with a helpful questionnaire so the program knows which sections apply to you, such as dependents, assets, and education, so you don’t wade into irrelevant matters. Initially, TurboTax also estimated how long the process would take to complete and asked how I filed last year, and no other service I tested previously did that either, which was helpful in estimating how long the process would take.