Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The war in Ukraine was an invitation to wake up to Europe, and the defense technology moved from a sector that most European VCS did not touch to one of the best fields of investment within deep technology.

This shift was captured in the latest Deal room A report on defense, flexibility and security (DSR) in EuropeWhich was released with the NIF Fund (NIF), which is multiple workers An initiative of 1 billion euros Make direct investments and support money in this field.

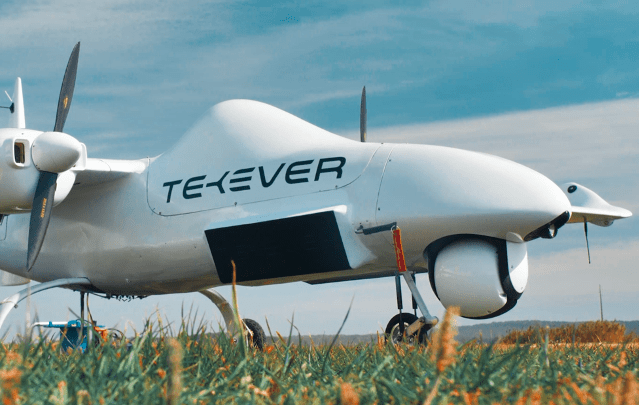

NIF portfolio includes startups such as TEKEVER, which is a double -based, which is raised A 74 million dollar chain b In November. In a total, DSR startups got a record worth $ 5.2 billion in investment capital last year, an increase of 24 % compared to 2023, and nearly five times in 2019.

Despite the boom, $ 5.2 billion is no more than twice the capital in which the American Defense Technology Company is located According to what was stated, you seek to raise Just for himself. However, this is also the highest level at all times of 10 % of all VC financing in Europe-an increase of 2.5 times over the past two years, according to Dealroom.

Its founder and CEO of Yorm Wijngaard said in A: statement. “It follows a continuous trend to put capital and innovation to work on the basic strategic needs of Europe, through deep technologies.”

With a DSR account now for a third of all the deep technical adventure financing in Europe, it is clear that the two overlap. This is because DSR is broader than defense technology, with recognition that the supply chain, quantum techniques, and energy can be equally decisive for sovereignty in the region.

This means that a wide range of startups now falls in the DSR pipeline, especially now after the growing defense budgets have made the idea of selling double technology in Europe less intense. Neve itself also hopes to help in this front; The veteran warrior in the British army, John Ridge, was recently appointed as head of adoption.

Divide and slowly adopt, VC appetite has long been an obstacle, but this changes. The emergence of startups with dual use in this development contributed: It has made it easier for public VCS to absorb the sector within their mandate, which often prevents them from investing in pure defense technology, not to mention weapons.

Pure Defense Tech only represents a smaller sub -group of total financing, but this is also at a height; Previous deals report a 1 billion dollars For 2024, an increase of five times since 2018. On the contrary, a wide range of European VCS is now with investments adjacent to defense technology, with more than 850 active investors in at least one DSR in Europe, according to the report.

This growth is especially amazing in Germany. With Munich and Berlin as its main positions, it was ranked first in Europe in DSR financing in 2024, followed by the United Kingdom and France. Ai Defense Tech Ruleing Star Helsing, which is based in Germany, A collection of about $ 487 million In the Ceneral Catalyst series last year.

However, these adjustments take time. The defense stock facility (Def), a fund worth 175 million euros ($ 182 million) was launched in January 2024 by the European Commission and the European Investment Fund (EIF), is about to announce its first investments, as the European Investment Bank (EIF’s Parents Organization I had to Update its rules On dual use technology.

However, among all the upcoming challenges, the lack of the founders is not one of them, as confirmed by the recent defense throughout Europe. “Despite the last growth, the technology of defense, security and flexibility is still a relatively emerging sector, but the data shows an active pipeline for early stage companies looking to change this,” said Wijngaard.