Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

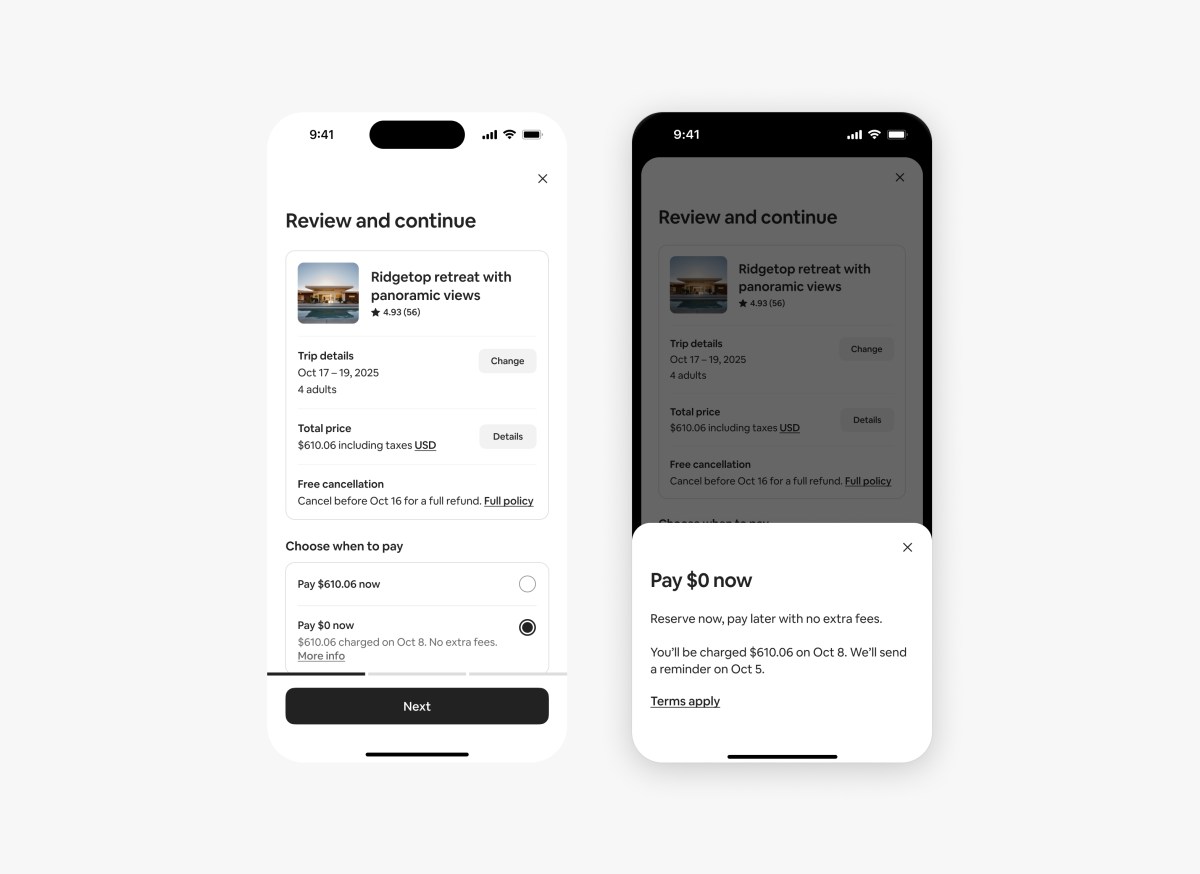

Airbnb said Tuesday it will launch its “Book Now, Pay Later” feature — which allows users to secure reservations without immediate payment — globally. This allows users to cancel their reservations if there is a change in plans without losing money upfront.

The company launched this feature in the US last year For domestic travel. Airbnb said properties with a “flexible” or “moderate” cancellation policy are eligible to book in advance. With this option, users are charged closer to the check-in date than at the time of booking. This feature mirrors the “buy now, pay later” payment plans that have become popular in e-commerce, making expensive travel more convenient by spreading out the costs. The company indicated that since its launch, this feature has seen 70% adoption of eligible reservations.

During its Q4 2025 earnings call, Airbnb said the feature helped increase nights booked this quarter.

“Book Now, Pay Later saw significant adoption among eligible guests in the fourth quarter. This also led to longer booking lead times and a mixed shift toward larger homes, especially those with four or more bedrooms, which contributed to an increase in the average daily rate,” Eli Mertz, Airbnb’s chief financial officer, said during the call.

Mertz noted that Airbnb’s overall cancellation rate jumped from 16% to 17% during the quarter, and was highest among customers using the advance booking product. However, it said this was “significantly insubstantial compared to the broader cancellations on the platform”.

Last year, the company surveyed American travelers in collaboration with Focaldata, a London-based market research and intelligence firm. Of those surveyed, 60% of respondents said that a flexible payment option is important while booking a holiday, and 55% said that they would use a flexible payment option.

The company has been experimenting with Pay Later products for years now. In 2018, Airbnb launched a product that allows users to book a property by paying 20% or 50% of the total fees. In advance, the rest later. In 2023, the company partnered with fintech company Klarna to allow users to pay for their stay in Four installments over six weeks.

TechCrunch event

Boston, MA

|

June 23, 2026