Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Moments before a bankruptcy judge approved the sale of Luminar’s lidar business, an anonymous party made a bid that apparently blew the $33 million lead bid.

That presentation, which emerged before Tuesday’s hearing, began a series of quick meetings between Luminar’s remaining leadership team, its lawyers, the “Special Transactions Committee” formed to handle the bankruptcy, and eventually the company’s entire board.

While the offer was “significantly higher,” there were “weaknesses” in the offer, according to Luminar’s lawyers. The company eventually decided to honor the $33 million offer it received from MicroVision during that time Monday auction.

The identity of who made this long-term offer has not been revealed, but Luminar’s lawyer said it was an “internal buyer,” meaning it likely came from company founder Austin Russell.

Russell had already done so I tried to buy the company Late last year before it slid into bankruptcy (and after he abruptly resigned as CEO). Representatives of his new company Russell AI Labs He previously told TechCrunch He was interested in bidding on the lidar business during the bankruptcy case. (Those same representatives did not respond to a request for comment on Wednesday.)

The hearing went ahead, and the sale to MicroVision was approved. The sale of Luminar’s semiconductor division to a company called Quantum Computing Inc was also approved.

The transactions will likely close in the coming weeks, after which, the company will cease to exist, putting an end to one of the most active suppliers in the emerging era of self-driving vehicles.

TechCrunch event

San Francisco

|

October 13-15, 2026

Russell’s goal of using lidar to help cars drive themselves will continue at MicroVision, according to its CEO Glen DeVos. As part of the asset sale, MicroVision will acquire Luminar’s lidar technology as well as its remaining employees, and he said he hopes some other talent laid off before the bankruptcy will be brought on board as well.

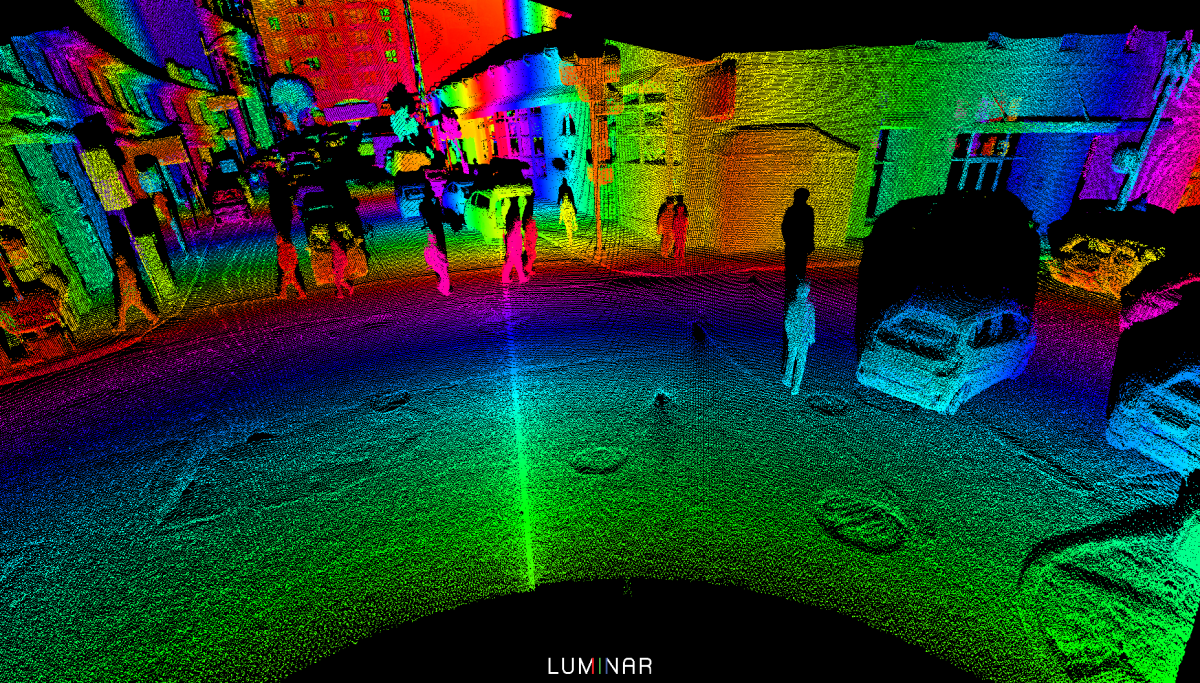

For DeVos, Luminar’s lidar technology is the piece MicroVision was missing from his company’s portfolio. The Redmond, Wash.-based company doesn’t have the same profile as leading lidar companies like Aeva, Innoviz, Hesai or Ouster, but that’s partly because it lacks the long-range sensing capability that is essential for cars.

MicroVision has a “very strong” software team, and a similarly strong short-term lidar team, DeVos said in an interview with TechCrunch. But DeVos, who spent a long career at automotive suppliers Delphi and Aptiv, and took over as CEO of MicroVision last year, wants to expand beyond his current markets for industrial use, security and defense.

“So when we looked at the Luminar engineering team, and what they did, we said, ‘Hey, that’s a great compliment from an engineering capability standpoint,'” DeVos said. “And that’s critical in this space in terms of trying to win the automotive business.”

DeVos said he hopes MicroVision can leverage Luminar’s existing business tie-ups with automakers — even ones in dire straits, such as Contract with Volvo — and use those as a stepping stone into making cars, which would represent a huge new pool of potential revenue for his company.

“I’ve been in the auto industry for a long time. I have experience where contractual relationships have gone off the rails, and I’ve worked hard to put those relationships back together again. We’ll look at each one of those things. We won’t assume that any of them are beyond salvage,” he said. “You never want to get there, but, you know, there are ways to put those pieces back together again.”

Although approval for the sale has been finalized, Tuesday’s show wasn’t the first time DeVos and MicroVision found themselves facing off against a mystery bidder.

During the hearing, Luminar’s lawyers and Rich Morgener, a managing director at Jefferies (who was helping manage the sale), revealed that another unidentified party had been putting together a bid dating back to January 12.

Morgener said this show was problematic from the jump. Initially, the party’s funding came from a “Chinese national company.” When Luminar expressed concerns about regulatory approval, Morgener said the bidder had replaced its funding with three different non-Chinese sources.

“One was family money, which we were eventually able to verify. The second was a Cayman Islands special purpose vehicle, which had a brokerage statement showing a large number of funds. Then we also had a European family office that was also part of the finance syndicate,” he said.

While lawyers and bankers were able to verify that “family money” could be relied upon, Morgener said the large number in the Cayman SPV appeared suspicious.

“The concern was that money would come in… (so) money could go out. It wasn’t like looking at a long, dated brokerage statement, where you could see the ebb and flow of various different securities,” he said. Proof of funds from a European family office source was also never provided.

Luminar’s lawyers never revealed the identity of the presenter, or whether it was the same party that made the offer that disrupted Tuesday’s hearing.