Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

California’s deficit is growing, uncertainty looms over the state, and state leaders may have fewer options than before to deal with it.

In summary

California’s deficit is growing, uncertainty looms over the state, and state leaders may have fewer options than before to deal with it.

This article is also available in English. Read it here.

Governor Gavin Newsom opened 2025 with an optimistic forecast : Buoyed by $17 billion more in revenue than previously planned, the state will have a modest surplus of $363 million for the 2025-26 fiscal year, he told reporters in January.

But life suddenly takes a turn.

The January wildfires that ravaged Los Angeles forced the state to spend billions of dollars on disaster relief and delay filing taxes for Los Angeles residents. The cost of Medi-Cal, the state’s health insurance program for low-income residents, he fired another $6 billion than expected. President Donald Trump’s tariff policies time and time again shook the stock market which California relies heavily on for tax revenue. In addition, the State presented a series of requests against the Trump administration for threatening to withhold federal funds for food aid, disaster recovery and other aid.

In May, Newsom no longer projected a modest surplus, but a deficit of $12 billion.

To close the gap, Newsom initially proposed drastic cuts to Medi-Cal. But the final budget he negotiated with state lawmakers relied heavily on domestic borrowing, using state reserves and freezing Medi-Cal enrollment for undocumented immigrants to avoid major cuts to other social services.

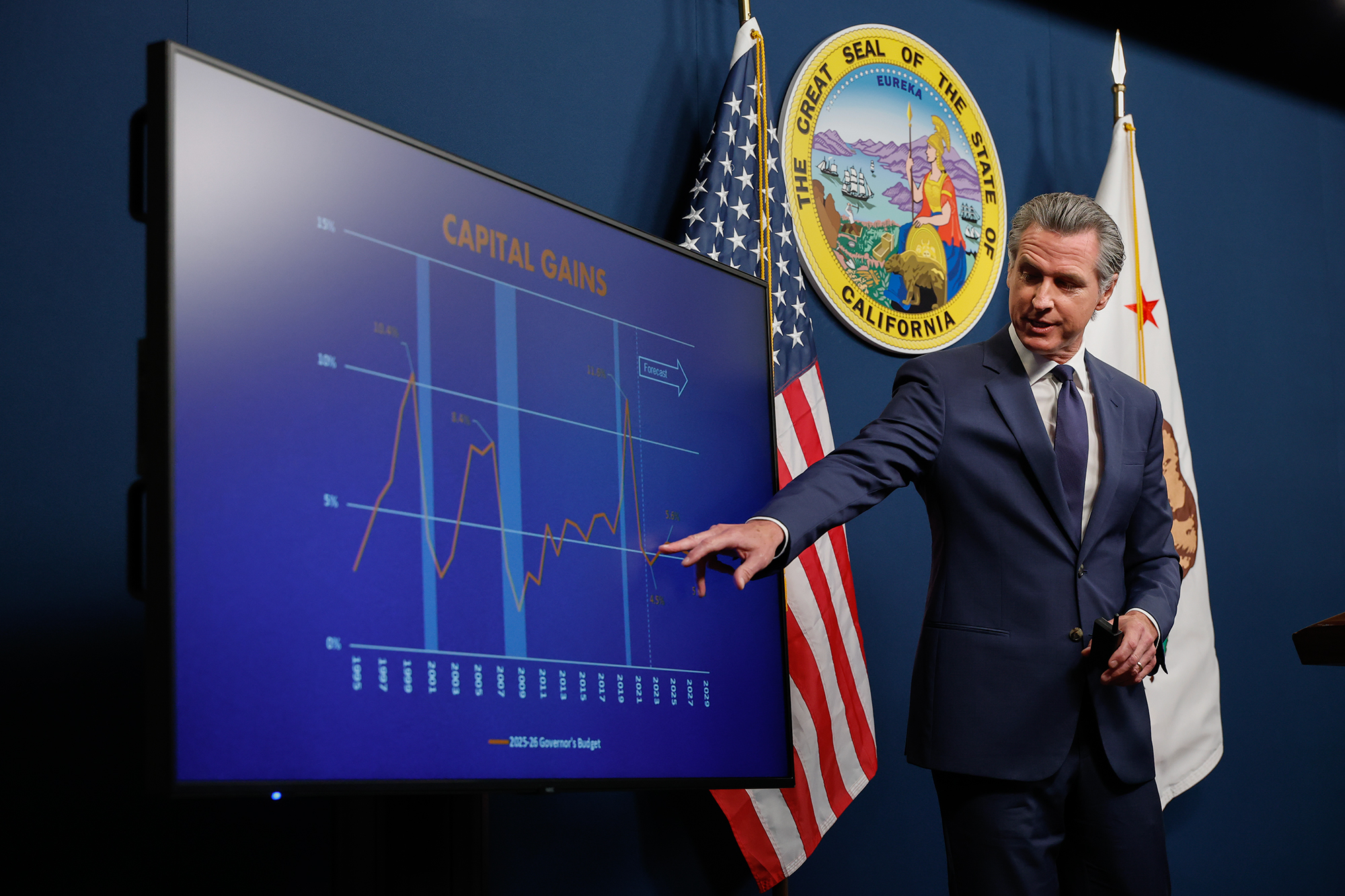

Although Democratic leaders have largely blamed the Trump administration for California’s budget woes, state revenue volatility is nothing new. California relies heavily on income and capital gains taxation of high earners, whose wealth often depends on the stock market. In 2022, the state posted a surplus of nearly $100 billion, followed by a projected deficit of $56 billion over the next two years.

The deficit is projected to reach almost 18 billion dollars next year, mainly because the state is expected to spend so much money that it will offset, if not eclipse, strong tax revenue fueled by the AI boom, the nonpartisan Legislative Analyst’s Office said in its fiscal outlook last month.

If the forecast holds, it would be the fourth straight year under Newsom in office that California has faced a deficit despite revenue growth.

Worse, the structural deficit could reach $35 billion a year by the 2027-28 fiscal year, the LAO said.

California faces $6 billion in additional costs next year, including at least $1.3 billion because the state must now pay more to cover Medi-Cal benefits under Trump’s budget bill. The state could also lose more funding from the federal government for housing and the homeless.

How can lawmakers fix it? The options are limited, as the state has already taken concrete measures to balance the books. The LAO notes that solving a persistent structural budget problem requires finding more sustainable sources of revenue, drastic cuts, or both.