Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

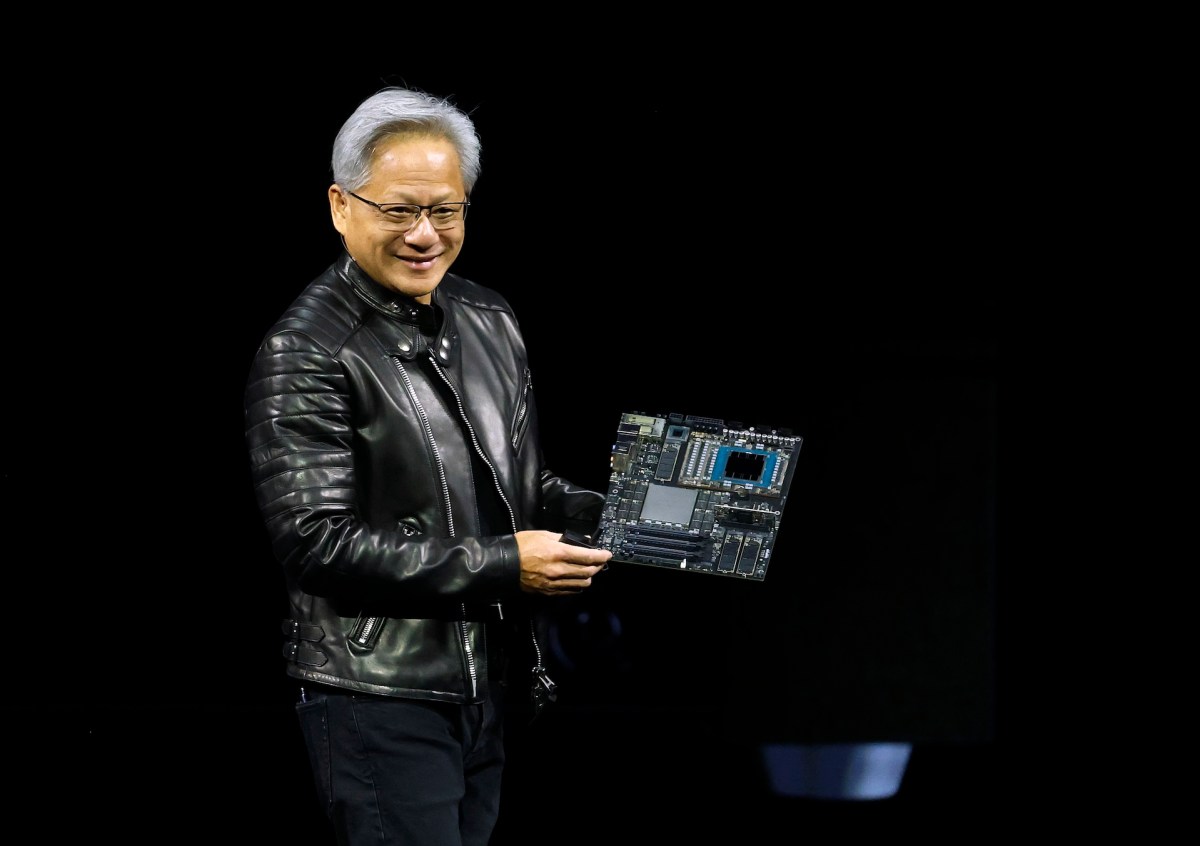

Nvidia founder and CEO Jensen Huang took an upbeat tone in the company’s third earnings call. And based on the company’s results, there may be a reason for this.

Nvidia reported revenue of $57 billion in the third quarter, up 62% compared to the same quarter last year. The company’s net income on a GAAP basis was $32 billion, 65% higher year-over-year. Revenue and profit results exceeded Wall Street expectations.

The revenue picture shows a thriving company thanks in large part to its data center business. Revenue generated from Nvidia’s data center business reached a record $51.2 billion, up 25% from the previous quarter and up 66% from a year ago. The remaining $6.8 billion in revenue came from Nvidia’s gaming business of $4.2 billion, followed by sales in professional visualization and automotive.

Nvidia’s chief financial officer, Colette Kress, noted in a statement to shareholders that its data center business was fueled by accelerated computing, powerful AI models and agent applications. During the company’s Q3 call, Chris said last quarter, the company announced projects for AI factories and infrastructure totaling 5 million GPUs.

“This request includes all markets, telecommunications service providers, sovereign entities, modern builders and supercomputing centers, and includes many high-profile construction operations,” Chris said.

The Blackwell Ultra GPU, unveiled in March and available in several configurations, has been particularly powerful and is now the flagship within the company. Previous versions of the Blackwell architecture have also seen continued strong demand, according to the company.

Sales of its Blackwell GPU chips have been “off the charts,” Huang said.

TechCrunch event

San Francisco

|

October 13-15, 2026

“Blackwell’s sales are off the charts, and its cloud GPUs are completely sold out,” Huang said in the company’s third-quarter earnings statement. “Demand for computing continues to accelerate and intensify across training and inference – each growing exponentially. We have entered the virtuous cycle of AI. The AI ecosystem is expanding rapidly – with more new core model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

Chris noted that the company’s shipments of the H20, a data center GPU designed for generative AI and high-performance computing, reached 50 million, a disappointing result due to its inability to sell to China.

“Large purchase orders never materialized this quarter due to geopolitical issues and the increasingly competitive market in China,” Chris noted on the earnings call. “While we are disappointed with the current situation that prevents us from shipping more competitive data center compute products to China, we are committed to continuing to engage with the governments of the United States and China, and we will continue to defend America’s ability to compete around the world.”

More importantly, Nvidia expects more growth with expected revenue of $65 billion in the fourth quarter, helping to lift its stock price more than 4% in after-hours trading.

The result, at least in Hwang’s view: Forget the bubble, there’s only growth.

“There’s been a lot of talk about an AI bubble,” Jensen said during the company’s earnings call. “From our perspective, we see something completely different.”