Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

From And WaltersCalmness

This comment was originally published by CalmattersS Register about their ballots.

When governor Gavin Newsom and legislative executives negotiated for the final state budget last June, they reduced some health and well -being programs to help end the multi -billion -dollar difference between income and output.

Nevertheless, they agreed more than doubling the state subsidy in the Southern California film and video industry, which enjoys a strong political hint by earning $ 750 million for tax loans to make producers shoot in California rather than in any other country or country.

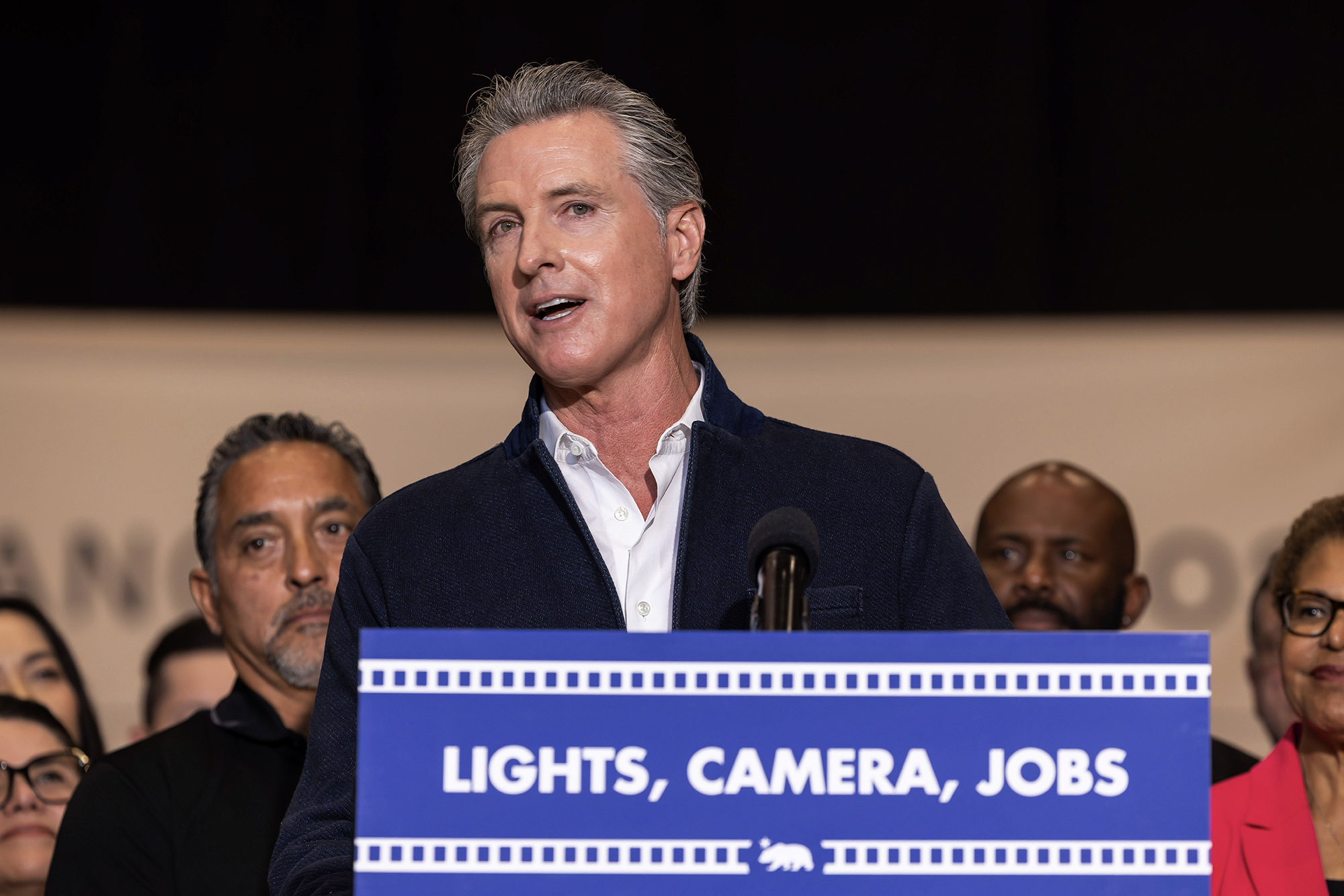

“You have to be competitive and now we are competitive,” News said when he signed Assembly Bill 1138 at a studio in Burbank. “Not to be the cheapest place to do business -this has never been a brand or motto of California to return from a century. We want to be the best place.”

The movie and video subsidy is only one way in which the state and local authorities of California direct the money preferred economic sectors Or even specific corporations. There are dozens of “tax costs” in the state tax systems – so much that the State Department of Finance publishes annually Report on who receives them and how much they costS

As the budget expands the new Hollywood tax subsidy, it also tightens the calculation of corporate taxes on the banking industry. In fact, this raises taxes on one sector to indirectly pay for them to reduce another.

Overall, California tax costs reduce revenue by more than $ 100 billion a year, approximately equivalent to 50% of the total budget of the state fund. The Union of Public Officers and their allies propose the state Close some corporate tax breaks To reduce its chronic deficiency.

At the local level, cities and some counties have been using reconstruction for decades to encourage investment in neighborhoods that are considered deleted, redirecting some taxes in so -called refinement areas back into developers’ pockets.

When Jerry Brown returned to the manager in 2011, he convinced the legislature to end the conversionthus transferring more taxes on ownership in school districts, which reduced the state’s financial obligation to schools and helped Brown balance the state budget.

However, the reconstruction is not the only way local authorities, in particular cities, use subsidies to encourage investment in the theory that public offices will see net benefits for revenue. Another way is to lure businesses that sell taxable goods and services, giving way to sales taxes back to sellers.

A A new report from the budget analyzer of the legislature Details of two ways to structure discount subsidies. One involves the conviction of the owner of a physical store of some kind to move from another community. The other is “Encourage retailers to displace the legally defined place of sale without changing the location of any real economic activity.”

Overall, one percent of the total sales tax – which can range from 7.25% to 11.25% of the sale price – is returned to the sales community. However, The designated point of sale can be manipulated To support a city that agrees to give way to this tax back to the seller. In the age of reducing sales in physical stores and increasing the Internet sales, determining a sale point can have large financial consequences.

Seth Kerstein’s report from the legislative analyst service estimates that discounts of $ 140 million were running from local authorities to sellers during the 2023-24 fiscal year, with the largest shares going to internet sellers and airlines for airlines and other transport enterprises.

Kerstein can calculate the total amount since the signed law of 2024 Newsom requires Requires Discovering Local Discount AgreementsS Newsom in 2019. vetoed a bill that would impose more restrictions by these agreements.

So tax discounts are just mutually beneficial business transactions, uninviting refusals or legal extortion? This is a fine line.

This article was Originally Published on CalMatters and was reissued under Creative Commons Attribution-Noncommercial-Noderivatives License.